What an encouragement when generous family and friends want to join you on your adoption journey! However, you need to have a plan regarding the acceptance of donations. If your donors are not concerned with a tax benefit, then I suggest creating an adoption sub-account at your local bank and saving all funds raised until your next agency fee is due.

Other foundations are faith-based and have specific requirements by which you must be accepted into a funding raising program. In these cases, once a family is accepted into the program, family and friends may donate on your behalf and receive a tax deductible receipt. There may be restrictions on the amount of donation given, such as only a donation greater than $25 will receive a tax receipt. Again, individual guidelines will vary. Money is sent to the foundation, and money is released to the adoption agency as needed, therefore, independent adoptions may be excluded from these programs. Any amount donated beyond your need or goal usually goes to the organization to be used on behalf of other adoptive families. Examples of faith-based organizations include Abba Fund, Christian Fund for Adoption and Lifesong for Orphans.

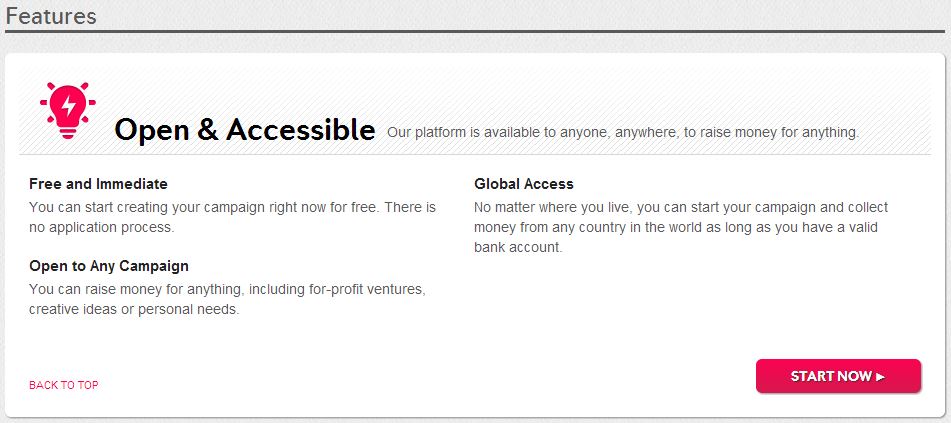

Indiegogo calls itself the “world’s funding platform” for any cause. Adoptive families can create a profile and set a fund raising goal. Indiegogo charges a 9% fee on all funds received. If you reach your set goal, 5% is returned to you, thus reducing the fee to 4%. They allow you to customize your own “campaign” by adding photos & videos.

Indiegogo calls itself the “world’s funding platform” for any cause. Adoptive families can create a profile and set a fund raising goal. Indiegogo charges a 9% fee on all funds received. If you reach your set goal, 5% is returned to you, thus reducing the fee to 4%. They allow you to customize your own “campaign” by adding photos & videos.One last option for receiving donations can be through your local church. By following your church constitution and current IRS guidelines, adoption accounts can be set up at your church by which funds can be received. This would operate similar to a church “mission” fund. Again, the specifics of operation will vary from church to church and will need to be determined by your church treasurer, board, and tax consultant.